Just kidding, they are called Non-Fungible-Tokens.

Alright, I was invited to do a webinar regarding art 2.0 and the impact of blockchain and tokenization on the art world. In my professional activities I am already involved in developing a tokenization engine to tokenize art for institutional clients, which is by itself super exciting. But it feels very.. “professional”, it leverages the ERC-1400 standard and is really revolving around developing a new revenue stream for the bank and generating new business cases for wealthy clients and institutional clients (funds). The value created can be summarized in the following use cases :

- Alternative investments and diversification opportunities for clients through asset exposition in art

- Offer the possibility to deal with inheritance of artworks without selling the artwork ( for sentimental reasons for instance)

- Transparency and Holistic overview of all assets for the clients (reporting, collateral calculation, lending opportunities, increase of leverage levels)

- And of course, new fees and commissions for the bank itself

This is great, and very interesting from a business perspective, but.. is it fun ? Well not really.

So I started to dig deeper. And got exposed to a whole new perspective. The perspective of the artists themselves ! And for the artists, for the collectors and for the private individuals the case does not reside in the fractional tokenization of physical art works, it is in the creation of non fungible tokens directly. NFTs. On the ethereum blockchain leveraging ERC-721.

I was not a huge believer in the start but I am starting to be. I actually own a few NFTs on the Opensea marketplace and I must admit that sometimes I log in and just stare at them. Happy to own my private collection. I am the first one surprised by this situation !

Here are the key points I have learned while digging.

What is an NFT ?

To make it simple, NFTs are non fungible tokens and are a way to represent and monetize digital assets including art, video, music, tweets, GIFs and memes. NFTs leverage blockchain technology to prove authenticity and ownership while permanently linking the digital file to its creator and then to the potential owner. Each NFT is a unique token and that’s what gives it value, only one person can own it.

But what’s the difference between a fungible and a non fungible thing ? Well, cash is fungible, if I put 100 coins into a jar and I put your coin in it, would you be able to get back your coin? Probably not. If I throw 100 different unique painting in it, you would probably be able to pick yours though. This is the difference.

An interesting question would be then why would you like to own an NFT ? Well, Googling an image of Da vinci’s Joconda would not make you the proud owner of a multi-million dollar piece of art history right? You would be able to see the Joconda, but you would not “own” it. You can buy posters and copies of an artwork, but if you are a collector or a fan you want the real thing, and the real thing can be considered as an NFT in the case of tokenized art on the blockchain.

The main different with tokenzing art with fungible tokens, is that here the goal is to be the full owner of a digital artwork and treat is as a collectable, not as a fractional investment into a bigger pool. The value does not reside in splitting an art work into smaller pieces, it’s about representing the whole art piece, on the blockchain.

NFT properties : Unique (metadata), povably scarce, indivisble, ownership, transferable and fraud proof

Why would you use an NFT for your art ?

The subject

Well the first thing that comes to my mind is the artwork itself, In the last century most of the art was done by clay, paint and instruments but today a sizable portion of the art creation is done on computers, as digital art. So, how to show, promote and hopefully reward the artists who create those videos, Gifs, audio files, jpges and other infinitely reproducible art formats? For those cases the NFTs are a solid way for the artists to get paid for their work and to actually represent the ownership of each artwork in a unique way.

The ownership

Now you want to be able to sell those with a mark of ownership, a sort of digital signature on a canvas, you want to offer to your clients and fans a way to prove that you, as an artist, have created this piece of work. The artist is minting the art piece and when he sells the token to a client, the client can check that the token is or was indeed sold by the artist himself in the first place. This token represents the ownership of the art piece.

In the image below we can see the creation of an artwork by artist maxbraun on Opensea.io for instance.

Traceability

The token is traceable, you cannot fake it and until the end of times the subsequent owners of this unique artwork will be traced and visible on the blockchain. This is a beautiful thing if you compare it to the regular opaque art world. So you can see who owned the piece of art before, but also how much he paid ! For every transaction the price is recorded as well and provides an audit-able track record concerning the previous transactions. Here as well differentiating itself from the regular art world where you don’t know who owns what, when something was owned, how much was paid for it.

There you go full history of one of my NFTs :

Rewarding the artist

Finally, it permits to the artist to sell directly to the customer, and to potentially also create a future revenue stream. Mechanisms such as “Resale royalties” exist to provide to the artists % of future sales of their creation, providing them with an incentive in case the price goes up and a potential royalty revenue for the future.

Is it only for speculative purposes ?

Begining of 2021 we saw the historical sell of Beeple artwork (Everydays : the first 5000 days) for 69 millions USD at Christies. Catapulting Beeple to the top three most valuable living artists. This alone shows that there is very strong interest in NFT.

Part of the crazy valuations today are probably indeed motivated by greed and speculation, there is no doubt about it.

But I think there is more than that. I think that today the border between what we perceive as reality and the digital world is slowly fading. In the 70s you were collecting records, you were proudly decorating your room with the posters of your favourite bands, today I think your room, your vinyl player and your environment are slowly melting into your digital room on your computer and your phone.

“If you spend 10 hours a day on the computer, or eight hours a day in the digital realm, then art in the digital realm makes tonnes of sense – because it is the world,” said OpenSea’s co-founder Alex Atallah for instance. The current Covid situation only pushes this way to look at things further. Buying a piece of art as a Token is then not so strange right ? You want to collect and display your possessions in your virtual room. NFTs are just a formidable tool to enable the collection of digital art.

Metakovan, who is the buyer behind the beeple sale said that he is not interested in speculation, his goal is to create a private collection of the first NFTs as he believes that this is an historic moment. Is it then really only for speculation ?

Other applications of NFTs ?

We can think of several use cases of NFTs which are related to art or not. Here are a couple :

Virtual museums

The Louvres does it, so why would it be ridiculous to imagine a virtual place on the internet where you could pay a fee, enter and go through virtual galleries showcasing NFTs ? The price of the ticket could be directly split and reward the artists. We already see such virtual showrooms, why not make them rewarding.

Gaming

NFTs have also huge potential in the gaming industry. Gaming is bigger than movies and hollywood, don’t ignore it. The trade of virtual asset in gaming is not new, it was done before on a shady secondary market, which was not interoperable, you could only sell your world of Warcraft accounts to other WoW players, you could only sell your Gold to other wow players etc. Why not permit to trade your digital assets in games on a global network and sell your Fortnite skin for crypto and then buy another skin in Apex Legends? Why not sell your high level character and all the effort you have put into it instead of just deleting your account ?

A second application in gaming would be the “play to earn” model, where players are actually building the content, the experience and the game itself from a shared engine and get rewards for it ? It’s called metaverses. I am currently investing in The Sandbox game, I find the concept absolutely brilliant. I highly recommend reading the white-paper here: https://installers.sandbox.game/The_Sandbox_Whitepaper_2020.pdf

Finally, in terms of IP and secondary markets It can also create a whole new secondary market for the games themselves, permitting players to sell their used games and still reward the editor with each subsequent sale. There is value for everyone. This was especially shocking to me, in the last decade we have willingly transitioned from physical copies of games, that we could resell peer-to-peer and simply lend to our friends to completely digital shops (steam) where you cannot do anything with your game once you finished it. This is simply the greatest hold-up by the gaming industry, effectively destroying any secondary market. Same for the PS5 that now comes in versions where everything is digital. Good luck to resell your games once finished or to lend them to your fiends! A system where you can sell those, but also reward the editor with every consecutive sell (sale royalties) would be a good compromise.

Watches and luxury goods

Those are an interesting use case as well, you could track the history of second hand luxury watches over the blockchain for instance. Offering a digital trail for your watch. But when you try to link the physical and the digital world, then you also face the risk of dissociation, what would prevent the seller from sending you the token and a fake watch ? I am sure there must be so solutions to that.

Brietling is doing that by the way, already now.

Collectibles

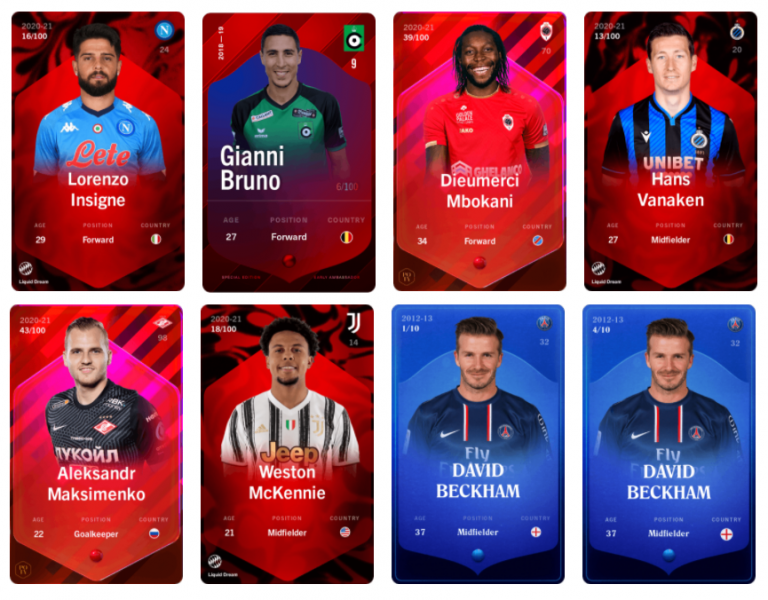

Finally, collectibles. You probably heard about cryptokitties and cryptopunks. But what else can be done ? When I was small people where buying, collecting and exchanging Football cards of their favorite players. But there was no transparency concerning the supply, the chance to get a specific card, the “minting” of the cards every year etc. What if the collectible supply was completely transparent, you know how much there is of a specific card, if it is owned already, who owns it in case you absolutely want to buy it, and what if those are not a static card anymore but an animation, a small clip? This is not fantasy, it already exists.

NFTs bring evident value to the collectible space, and for me this remains as the main use cases for those.

Crypto Domains

Ethereum domains (making ethereum addresses more memorable), you can basically buy a domain name in .eth (ENS) or .crypto (unstoppable domains) and link it to your wallet public address. Any transfer done to your new domain name will be automatically rerouted to your crypto wallet ! In my case, if you want to tip me, please use : juliendonnet.crypto !

Main difference would be that ENS is on a yearly rent, Unstoppable domains are for life.

What about the ecological impact ?

Carbon footprint is an important topic. The ecological impact of the proof of work consensus is clear, hundreds of thousands of calculation units, ASICS, are running day and night to solve the cryptographic puzzle, this process is know to be very energy demanding. Some of the crypto farms are probably using clean energy leveraging dams and geothermic energy but I think it is safe to say that in any case the appetite for energy of the POW is a problem.

But alternatives exists, currently the Ethereum blockchain is transitioning to the proof of stake consensus which would cut by 99.98% the energy consumption.

Ethereum is by far the most popular blockchain regarding tokenization (NFTs or Fungible tokens) but if the wait is too long then other solutions exists. Some artists are publishing their work on the Tezos blockchain as NFTs, the tezos blockchain is already a POS consensus and marketplaces exist for NFTs on tezos. The Tezos community really pushes the narrative around “Clean NFTs”, and it works, Opensea announced a future integration with Tezos and the Hip et nunc Tezos NFTs marketplace is getting traction.

The artist Antoine Shmitt from France is an example of such a commitment : https://www.antoineschmitt.com/carre-noir-xtz/

How difficult is it for a young artist to get into NFTs ?

Quite easy. I have done it in 10 minutes last week to test the process. I created an image using google dream by merging several images into one and then published it as an NFT on one of the main platforms (Opensea), the process was very straight forward. You can check the whole thing in my previous article.

Keep an eye on the fees though, currently it is quite expensive to transact and mint on the ethereum blockchain. I am not an artist so I doubt anyone will buy my chef d’oeuvre but it is there on the blockchain and available.

The beautiful thing about it though is that’s Its open, anyone can do it, there is no discrimination. Especially for a new artist, NFTs eliminates the need to have a network, a middle man and to go through galleries, be subject to gatekeeping. It permits to offer a new way to monetize your art. You are not supposed anymore to do free work on deviant art to make a name for yourself and be eventually then selected for your dream job or to expose, you can directly create your own gallery and monetize it on the internet, it’s great. To go one step further behind the operational minting and publishing, I think that the reputation of the artists and the process of creating the NFT is quite important as well in order to generate value for the NFT itself. I am a big fan of Algorithmic art and everything that melts technology and art together, in that context I think than NFTs are a particularly good vehicle.

Are there any problems with NFTS ?

Of course, as in any domain there are some topics which are problematic :

- Copyright : While NFTs are supposed to validate ownership, there’s no guarantee that the person creating an NFT owns the underlying artwork they’re selling

- Ecological footprint : already discussed above

- Inflated prices and price discovery due to newly minted cryptocurrency millionaires who have digital coin to burn and relatively few places to spend it (risk of losing everything)

- Frenzy that does not make sense in some cases (Twitter NFTs ? Corporate NFTs ? ), I have very little sympathy for NFts being minted by Mcdonald and Twitter.

And this concludes my researches concerning NFTs ! Hope that it makes it more “comprehensible” and more concrete.

Which blockchain to use ?

The blockchain to be used depends on the use case of course, the desired level of privacy is also a parameter. Currently we can confidently say that the main infrastructure in the tokenization space is the Ethereum blockchain. It is widely used, most of the innovation regarding smart contracts and tokenomics has been done there and it is trusted due to its size and decentralized aspects.

As it is the main platform used it also suffers from its success, today the fees are outregeous due to volume congestion and as such users complain about the cost to transact on it, effectively locking out smaller wallets. A simple token swap on Uniswap can cost 40 dollars, a transfer from a metamask wallet can cost more than 10 dollars, hindering the use cases involving small transactions.

The consequence is that many copy cats are launching their own blockchains which are benefiting from years and years of lessons learned on the Ethereum network. Those blockchains can generally propose lower fees and higher transaction throughput, but usually at the expense of decentralization (i.e the Binance smart chain).

We can see some part of the tokenization business moving to such challengers. But Ethereum remainsking. Hopefuly the layer 2 solutions, the london and berlin upgrades and proof of stake will enhance the scalability of the Ethereum network and cement its position as a leader in the tokenization space.